EBANX drives the next phase of credit cards in LatAm with network tokenization for cross-border transactions

December 11, 2025

Through EBANX, global companies can implement Network Tokens to increase their credit and debit card approval rates in Brazil, Colombia, Chile, Peru, and the Dominican Republic

SINGAPORE, December 11, 2025 – EBANX, a global technology company specializing in payment services for emerging markets, has extended its operations with Network Tokens to five Latin American countries. The technology replaces the card’s sensitive Primary Account Number (PAN) with a secure, dynamic token (DPAN), thereby protecting cardholder data while ensuring a smoother payment experience.

In tests conducted across Latin America, EBANX identified a reduction in credit card declines due to fraud and security issues by up to 86%. After launching operations with the technology in Brazil and Chile, EBANX has expanded payment processing using Network Tokens to Colombia, Peru, and the Dominican Republic.

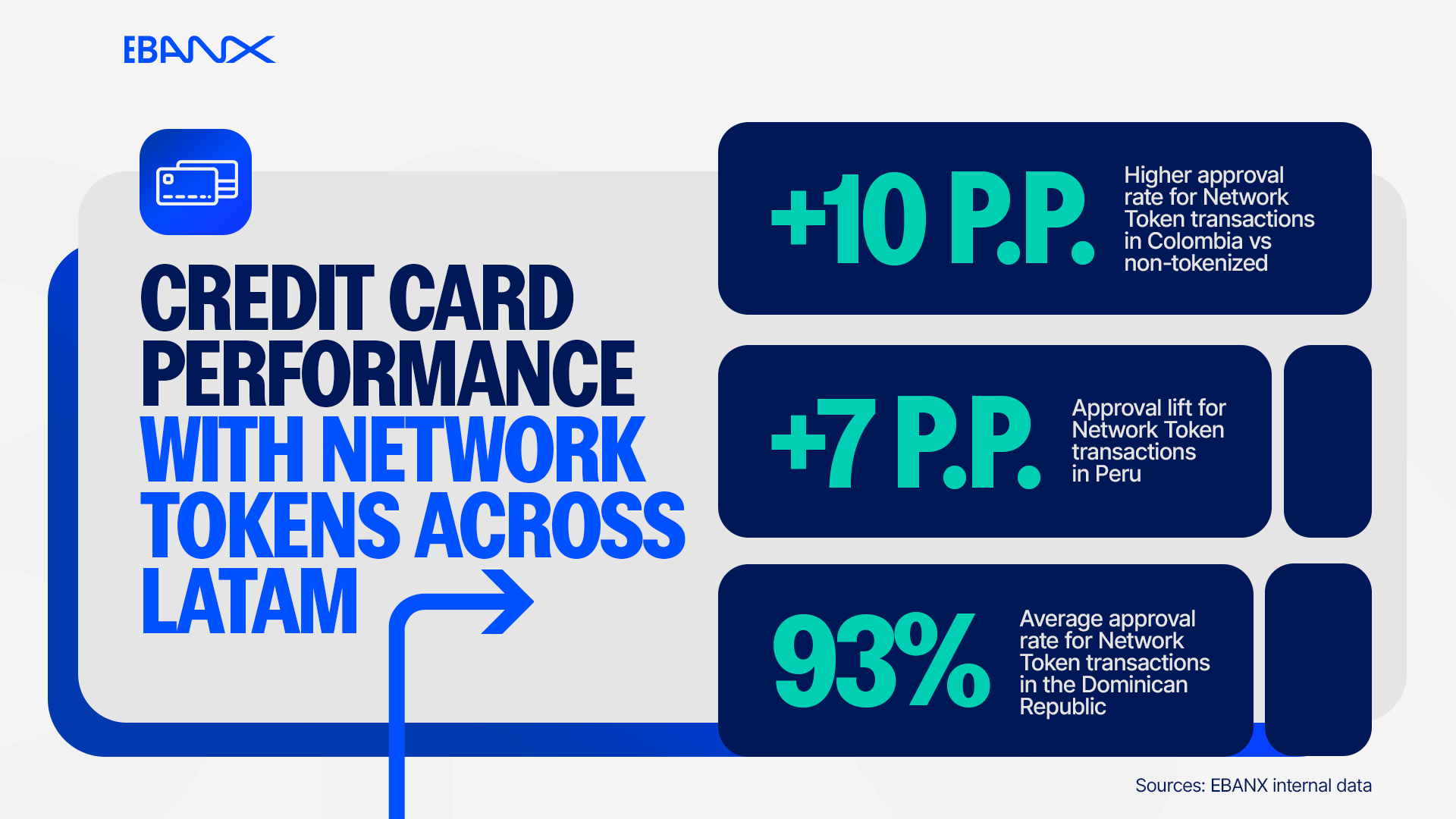

In Colombia, EBANX now processes over two million transactions with the solution per month. Internal data shows that the average approval rate for payments with Network Tokens in the country is 10 percentage points higher than for those without. Adoption has reached 87% among merchants, with 111 companies already using the technology across sectors such as SaaS (Software as a Service), online retail, and gaming.

In Peru, EBANX is currently the only Payment Service Provider (PSP) using Network Tokens across both major international card networks, Visa and Mastercard. “We are opening the door to new technology, smoother transactions, and higher approval rates in Peru for the first time,” said Juliana Etcheverry, Director of Country Growth, South LatAm at EBANX. “E-commerce in the country is projected to exceed USD 30 billion annually by 2028, with around 60% of transactions processed via credit or debit cards,” she added, citing data from Payments and Commerce Market Intelligence (PCMI) sourced by EBANX.

Seven out of ten card transactions processed through EBANX in Peru already use Network Tokens. Internal data shows that this technology has improved transaction performance by more than 7 percentage points compared to non-tokenized transactions. Merchants in the SaaS (software as a service) sector saw the largest uplift, at 8 percentage points. Social media and online education companies experienced increases of over 6 and 7 percentage points, respectively. Online retail and streaming merchants saw around 3 percentage points of uplift. The average approval rate already exceeds 80% in certain verticals, including online retail and social media.

Next steps

In the Dominican Republic, where 84% of the digital transactions are made by credit and debit cards, the company is marking the first implementation of Network Tokens. The initiative builds on EBANX’s growing partnership with AZUL, the leading electronic payments provider in the Dominican Republic and a subsidiary of Grupo Popular. Since 2023, both companies have worked together to increase access to e-commerce and enhance digital transactions in the country. In its early phase, the operation is already seeing a strong 93% approval rate for transactions using Network Tokens.

“With this launch, we are taking another step forward in enabling safer and more efficient online payments in the Caribbean markets,” said Alyson Grosshandler, Director of Country Growth, North LatAm at EBANX. “Through Network Tokens, merchants in multiple industries, including gaming and online retail, will benefit from higher approval rates and a significant reduction in fraud-related declines”.

“We are proud to collaborate with EBANX to bring Network Tokenization to the Dominican Republic,” said Eugene A. Rault Grullón, Executive Vice President of Servicios Digitales Popular, AZUL. “This technology strengthens security, increases approval rates, and provides our merchants and customers with a more reliable and seamless payment experience. Together, we are driving innovation in the local payments ecosystem and expanding access to e-commerce across the country.”

EBANX plans to extend the Network Token implementation to additional markets in Latin America in the coming months.

ABOUT EBANX

EBANX is the leading payments platform connecting global businesses to the world’s fastest-growing digital markets. Founded in 2012 in Brazil, EBANX was built with a mission to expand access to international digital commerce. Leveraging proprietary technology, deep market expertise, and robust infrastructure, EBANX enables global companies to offer hundreds of local payment methods and streamline cross-border payments across Latin America, Africa, and Asia. Officially licensed as a Major Payment Institution (MPI) by the Monetary Authority of Singapore (MAS), the company is committed to supporting merchants with full regulatory compliance. More than just payments, EBANX drives growth, enhances sales, and delivers seamless purchase experiences for businesses and end-users alike.

For further information, please visit:

Website: https://www.ebanx.com/en/

LinkedIn: https://www.linkedin.com/company/ebanx

Related Releases

Network Tokens cut credit card fraud declines in emerging markets by 86%, EBANX reports

October 3, 2025

EBANX partners with digital wallet PicPay to offer a new payment option for international e-commerce in Brazil

November 30, 2020

EBANX launches new automated payments solution to ease and speed high-value transactions in LatAm's USD$11 billion B2B SaaS/Cloud market

September 13, 2022

Get in touch with our Public Relations office.

For press inquiries, company information, press releases and more, please fill out the form beside or contact our press team via e-mail: press@ebanx.com.