What digitalization means for SaaS growth in Latin America

May 27, 2022

6 minutes

Contents

SaaS Landscape in Latin AmericaDigital access allows businessHome office expedited SaaS demandWhat does this mean for global SaaS brandsEvery year, more and more of the Latin American region becomes connected. The number of customers with internet access has never been so high. Smartphone adoption is skyrocketing, and so on. This increased digitization has translated into the growth of many tech businesses, especially the software as service industry (SaaS).

Latin America has proved to be a very promising SaaS market. It has an expected CAGR of almost 24% by 2023 and, despite the pandemic, investors have pumped USD 19.5 billion investment dollars into businesses across the region in 2021. Considering investment on IT alone, it grew 8.5% in 2021 and, according to an IDC report, it can grow up to 9.4% this year.

As the number of Latin American businesses entering the global stage keeps increasing, the demand for digital services and resources that help to propel them forward are also growing. Experts believe that the COVID-19 boosted financial and digital inclusion and forced companies to innovate and extend their ecosystem to find new partners. This has generated new growth opportunities for SaaS companies since the demand for their products/services skyrocketed.

“The COVID-19 pandemic showed that organizations that were well on the path to being digital businesses are surviving much better, even thriving under pressure. Future success is no longer based on imagining what the future will be like or struggling to adapt to immediate disruptions; rather, in continuous innovation in response to the challenges and opportunities of “every moment”. On the other hand, managers have realized that innovation is not only internal; they need to extend it to their ecosystems, even with partners”, said Ricardo Villate – IDC Group Vice President for Latin America – when interviewed by Bnamericas.

As you can see, for international SaaS businesses looking to grow in Latin America or deciding whether to land in the region, here are other key insights and components of this vertical’s growth that you should consider.

SaaS Landscape in Latin America

There is a lot of room for opportunities in the Latin American market. From the companies that create these products, to the demand for resources like Hubspot, Mailchimp, Survey Monkey and others that are commonly used as business tools.

According to Statista, in 2021, the SaaS industry in Latin America valued USD 22.1 billion, with the enterprise software segment accounting for nearly 40 percent of the market. For businesses around the region, SaaS adoption has increased 31.5% during the pandemic. Additionally, 43% of small and medium sized businesses in Brazil confirmed that they purchased new SaaS tools to make it easier for their teams to work remotely.

In the region, Brazil and Mexico are the biggest market for digital goods. There is an increased number of businesses that need tools to allow them to scale and optimize marketing, sales, customer relationship management, financial controls, payments, and more. As a result, the SaaS industry has seen excellent results year after year.

Digital access allows business

Following a worldwide trend, the reliance on software has been increasing in Latin America. Now, it is the century of artificial intelligence, machine learning, automation, and 5G technologies. Over the last 10 years, the region has quickly emerged as a technology market to take notice of. Companies like Nubank, Rappi, and EBANX have gained global recognition and the coveted Unicorn valuation. Simultaneously, the number of consumers and regional access to internet, and digital adoption of mobile phones, online payments, and more has grown.

Almost 75% of Latin Americans have access to the internet. Between 2005 to 2020, the percentage of individuals using internet in the region increased 340%. It’s safe to assume that there is a direct correlation between digital access and business growth. There are several factors indicating that this is just the beginning and we can expect more from this vertical in the next few years, including an increase in demand for SaaS and business tools that help companies to truly thrive. For instance, due to the pandemic, Microsoft saw the usage of Teams grow 1,000% with 40% of all calls made in Mexico and Chile being video calls. People are adapting the way to do business, and investing in the resources needed to ensure that they are moving forward in any way possible.

Home office expedited SaaS demand

COVID-19 and global lockdowns have forced a variety of industries to change the way they have operated and turned daily life as we know it upside down. Although now, in 2022, is under control, many companies have adopted the home office or model or a hybrid one.

Note that, conferencing and collaboration tools such as Zoom, Microsoft Teams, and Google Meet have gone through the roof. Companies like Pingboard, which were not initially focused on connecting people at bay, redesigned their businesses to meet new demands. For global brands offering their products to this region, making it as accessible and localized will be key in not only adoption, but also in retention to ensure that this technology is a staple once remote work orders lift.

What does this mean for global SaaS brands

Looking to the future we believe that the SaaS evolution across Latin America has only just begun. More technology companies will achieve greater valuations, and as a domino effect this demand will come back to the SaaS tools they use to scale their brands.

Access will always be key. For SaaS brands looking to better reach the region and gain new customers across Brazil, Mexico, Colombia, and even smaller emerging markets like Peru, Chile and more, making sure that your product is both affordable and attainable is of the utmost importance.

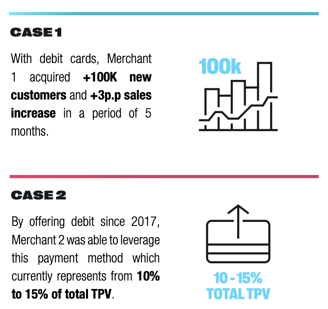

For starters, charging in local currency is table stakes. 54% of Brazilians say they won’t purchase from a digital brand if it is charged in USD. For higher ticket SaaS tools, invoice is often the most popular form of payment. Make sure that your invoices are issued and can be paid in the currency of your customer in this region. Also, for lower ticket SaaS purchases, enabling local card payments or debit can help to boost sales exponentially. Besides, since half of Latin Americans are unbanked, accepting alternative payment methods, such as instant payments and digital wallets, can you increase your potential customer’s base.

Bear in mind that, if your SaaS business has a subscription service, you will also need to offer recurrent payment options that fits the local needs. Subscription payments are nothing new to Latin Americans, as installments are a common and preferred way to pay for everyday purchases like appliances, luxury items, and travel.

At the end, brands that put the right pieces in place and invest in localizing their service and checkout experience, have the opportunity to gain massive market share over the next years.

EBANX Retail & Marketplace Solution

It’s time to enhance your retail marketplace in Latin America with a tailored approach to payments.

Get the guide