All eyes on Latin America: a bright spot for investment, disruption and innovation

One of the best performing regions for investment funds worldwide, Latin America registers 18 new unicorns in 2021 alone. In total, nearly 50 Latin companies are now part of the billion-dollar club - and counting!

some of the latam unicorns

Digital thinking, digital living: technology is king, queen, and everyone in between

Super apps, smart gadgets, a tech-savvy generation or wannabes. There's no going back on digitization! Think about it. Most of what we routinely do either will be or is already being transformed by technology:

Banking

Shopping

Logistics

Learning

Working

Health

Transportation

Entertainment

Food

Not only have we been consuming differently, how we pay for our consumption have also changed.

Market Overview: Digital Payments

Size and growth of the digital payments market (in U.S. dollars)

3.47 Billion

Number of people making digitally enabled payment transactions

$4.93 Trillion

Total annual value of digitally enabled consumer payments

+24%

Annual change in the value of digitally enabled consumer payments

$1,421

Average total annual value of digital payment transactions per digital payment user

Source: We Are Social | Hootsuite

Every vertical segment is being pushed out of their comfort zones to embrace change and challenge themselves into delivering a remarkable digital experience to customers.

Such trends are bigger than any political or economic instability. Hence the spotlight of investments shining brightly on Latin American businesses of all kinds.

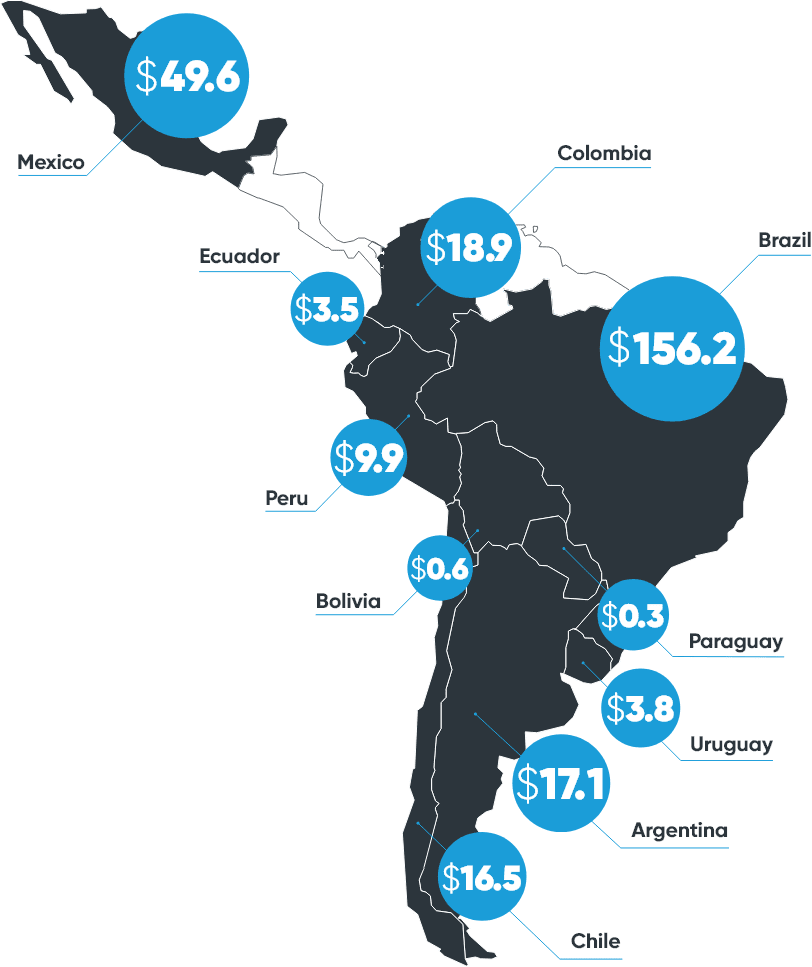

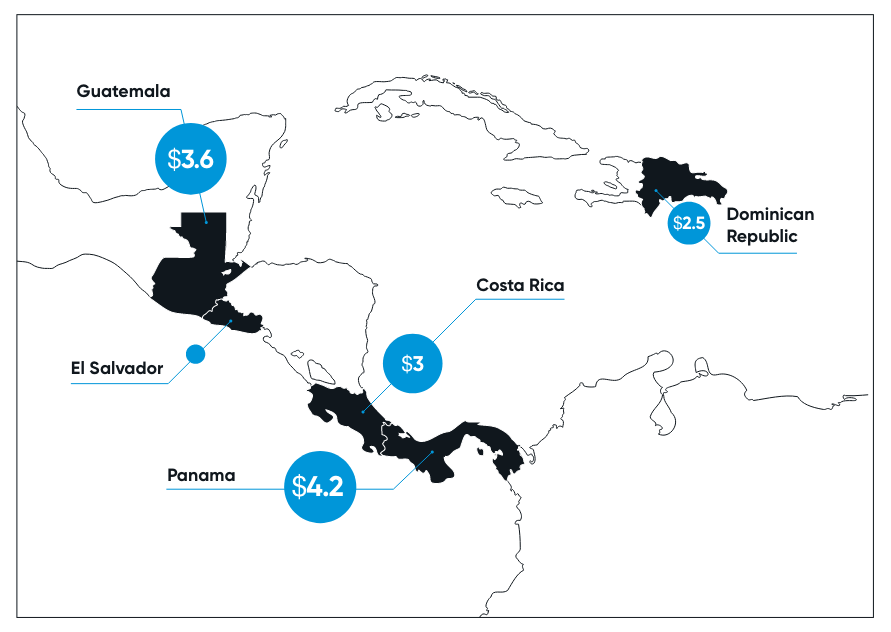

Brazil, yes,

but also…

Although Brazil represents over half of the LatAm market, countries like Mexico, Peru, Colombia, Chile and Argentina are growing fast.

| Country | Market size | Annual growth |

|---|---|---|

| Brazil | $156.2 | 41% |

| Mexico | $49.6 | 41% |

| Colombia | $18.9 | 32% |

| Argentina | $17.1 | 40% |

| Chile | $16.5 | 25% |

| Peru | $9.9 | 40% |

| Panama | $4.2 | 40% |

| Uruguay | $3.8 | 35% |

| Guatemala | $3.6 | 60% |

| Ecuador | $3.5 | 51% |

| Costa Rica | $3.0 | 26% |

| Dominican Republic | $2.5 | 26% |

| El Salvador | $1.2 | 50% |

| Bolivia | $0.6 | 111% |

| Paraguay | $0.3 | 60% |

Positively impacted by mobile commerce, retail digitization and access to localized methods, Latin America has opportunities everywhere.

LatAm trends to watch

in 2022 and beyond

In a hyper growth market, where e-commerce is expected to grow 30% every year through 2025, new payment methods emerged and have been granting access to millions of people - not only in the financial system, but the digital market as well.

Latin America is set to be the fastest‑growing e‑commerce market globally

Embrace the change

Become an active party in LatAm’s boom for disruption

Please fill out the form if you'd like to speak to one of our specialists about the opportunities you could embrace in Latin America with a little help from EBANX: