your payment strategy is outdated if you are not offering alternative payment methods

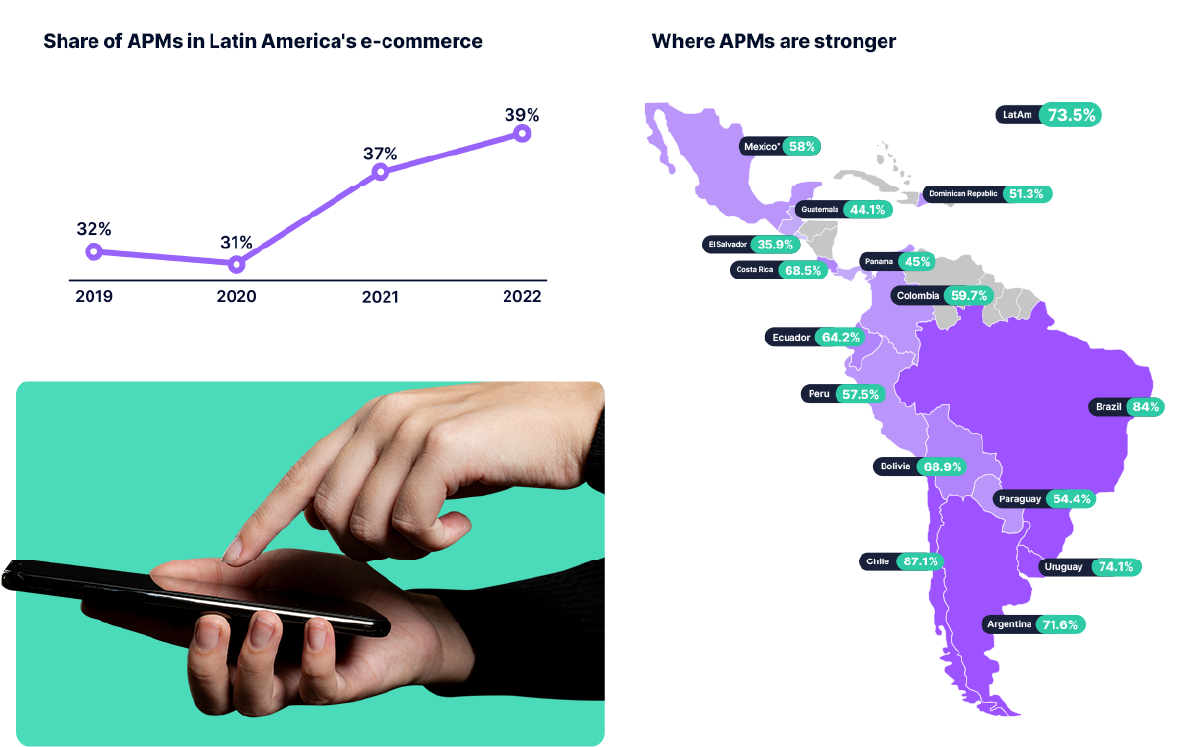

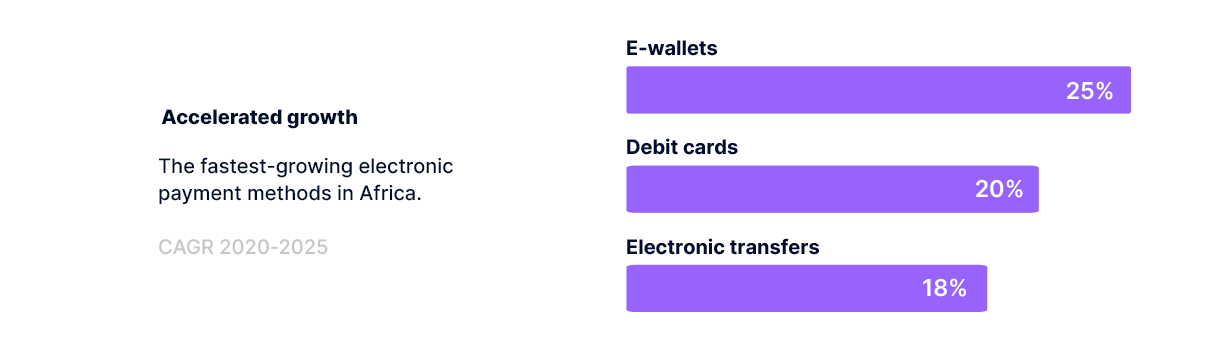

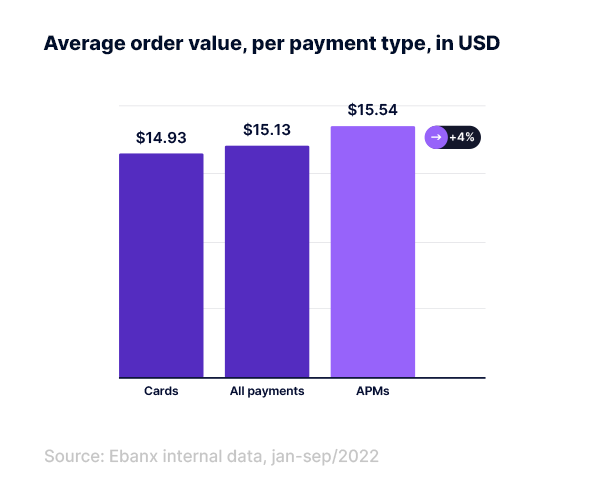

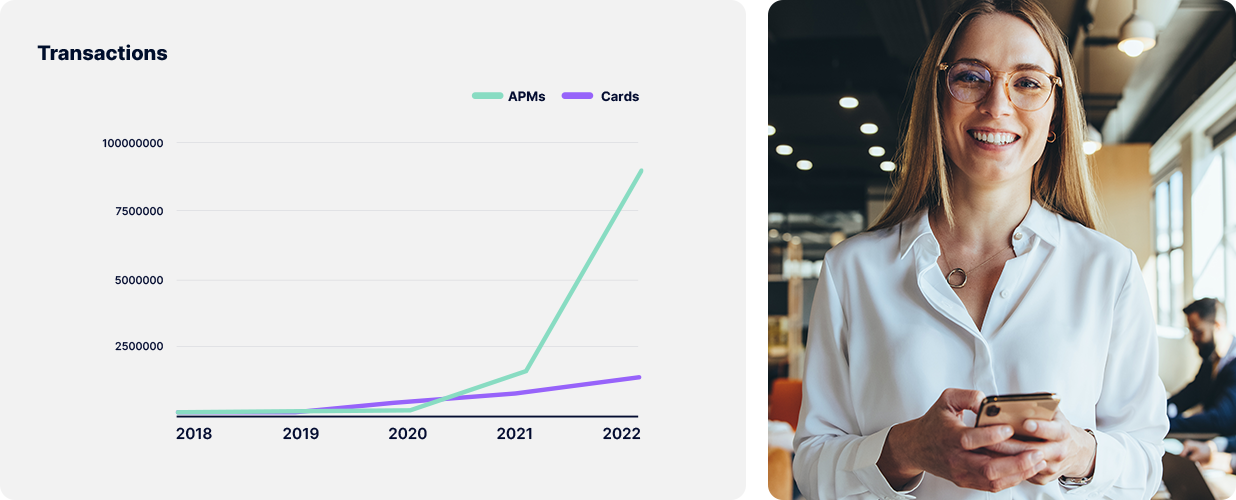

If your payment offering only considers cards in Latin America and Africa, you must bring it up to date with APMs — Alternative Payment Methods. Widely adopted in those regions, APMs are a strategic ingredient for global brands willing to increase market share while lifting revenue.

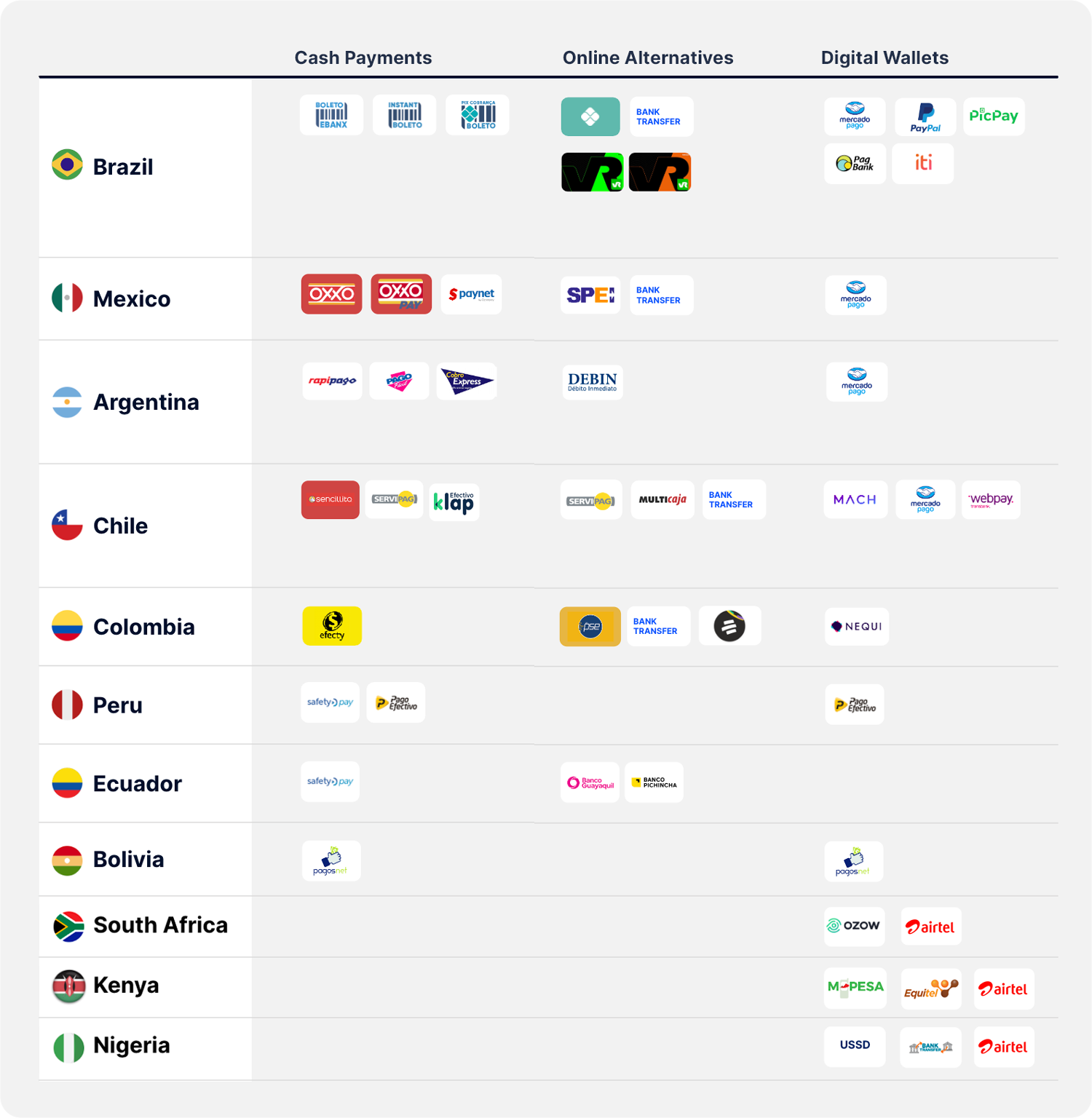

Whether it's cash payments, digital wallets, bank transfers, or mobile money, EBANX is the leader in APMs offering in rising economies.